What is an eCommerce payment gateway

Being able to accept debit and credit cards online is an important feature for eCommerce websites, because they are the most common forms of payment for eCommerce transactions.

It would be difficult for an eCommerce website to operate without supporting debit credit and cards due to their widespread use.

A payment gateway is a service provided by credit card processing companies that enables online payment processing for small to medium businesses and eCommerce websites by authorizing credit cards or direct payments.

The payment gateway provider may be a bank, but can also be an online payment services provider, such as Authorize.net, PayPal or Stripe.

A payment gateway enables a payment transaction by transferring information between a payment portal (such as a website, mobile device or shopping cart software) and the payment processor or acquiring bank.

With the variety of payment options available to customers, it’s crucial for merchants to consider all forms of payment to ensure a positive customer experience.

A Discover Card study found that 24% of U.S. customers abandon their shopping cart when their preferred payment option is not offered, and 50% of online shoppers surveyed listed a variety of payment options as an important factor when checking out online.

By incorporating eCommerce components such as shipping, order tracking and enhanced payment gateway features that create a more seamless checkout experience merchants can reduce shopping cart abandonment.

How payment processing works

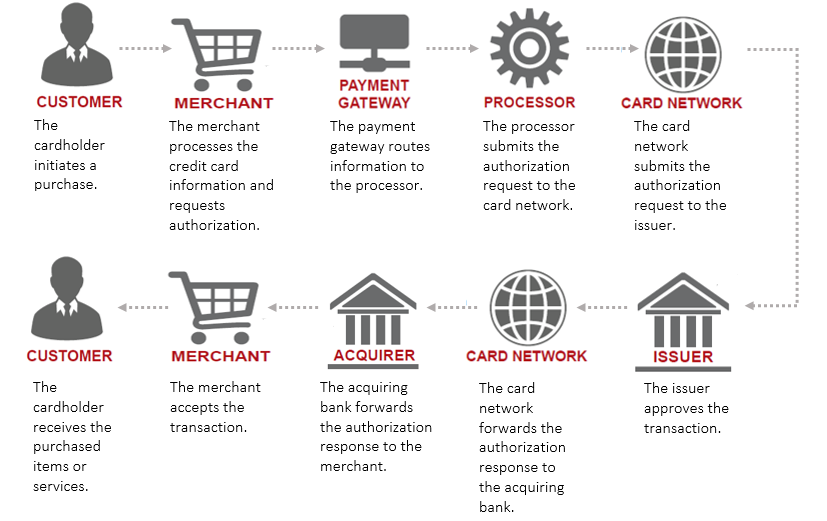

A payment gateway performs a number of tasks to process the transaction when a customer places an order from a payment gateway-enabled eCommerce website.

A payment gateway performs a number of tasks to process the transaction when a customer places an order from a payment gateway-enabled eCommerce website.

When a customer places an order on an eCommerce website by pressing the ‘Submit Order’ or equivalent button, the customer’s web browser encrypts the information to be sent between the browser and the eCommerce website via a secure connection made over Hypertext Transfer Protocol Secure (HTTPS) that is encrypted using Transport Layer Security (TLS).

The eCommerce website forwards the transaction details to the payment gateway. This is another encrypted connection to the payment server hosted by the payment gateway.

The payment gateway may enable the transaction data to be sent directly from the customer’s browser directly to the payment gateway, bypassing the eCommerce website’s system. This reduces the merchant’s Payment Card Industry Data Security Standard (PCI DSS) compliance requirements without redirecting the customer away from the website.

The payment gateway converts the transaction data from XML or JSON to ISO 8583 or another message format understood by Electronic Funds Transfer (EFT) switches and then forwards the transaction information to the payment processor used by the merchant’s acquiring bank.

The payment processor then sends the transaction information to the credit card association (I.e.: Visa/MasterCard/American Express). In the case of a Visa or Mastercard, the card association routes the transaction to the correct card issuing bank.

The credit card issuing bank receives the authorization request, verifies the credit or debit available and then sends a response back to the payment processor with a response code (I.e.:: approved, denied).

The payment gateway receives the response, and forwards it back to the eCommerce website, where it is interpreted as a relevant response. Finally, the shopping cart software can finish processing the order.

Payment gateway features

Your eCommerce website’s performance can be greatly improved by upgrading your shopping cart software to effectively use payment gateway features.

An eCommerce website’s average performance improvements:

- 225% Increase in conversion

- 112% Increase in return customers

- 54% Decrease in abandoned carts

For example, with Authorize.net’s payment gateway, you get the following payment gateway features included free.

Payment gateway features include:

- Secure online payments

- Retail payments

- Mail and Phone orders via virtual point of sale terminal

- Advanced fraud detection

- Customer information management

- Automated recurring billing

- Simple checkout

- Invoicing

- Easy to use and well documented Application Programming Interface (API)

For retail locations, you have the option to use either a Virtual Point of Sale (VPOS) solution or choose from dozens of pre-integrated, third party POS systems.

A virtual terminal enables you take mail and phone orders from your customers.

Mobile transactions are also accepted via the payment gateway’s free mobile app.

For check payments, there is the fully integrated electronic check payment method which accepts and processes payments from bank accounts directly, through your website or the Virtual Terminal.

While payment cards remain the primary method of payment, the Authorize.Net API supports several alternate payment types, such as PayPal and Apple Pay.

Advanced Fraud Detection

Many payment gateways provide tools to automatically screen orders for fraud in real time prior to the authorization request being sent to the payment processor.

Tools to detect payment fraud include geolocation, velocity pattern analysis, ‘black-list’ lookups, delivery address verification, computer finger printing technology, and basic Address Verification System (AVS) checks.

You can use the fraud management feature of the payment gateway to access suspicious transactions and then approve or decline them. By identifying and understanding why transactions are being declined, you can pro-actively make changes to reduce your risk and cost.

A payment gateway with advanced fraud detection capabilities includes configurable fraud filters designed specifically to identify, manage and prevent fraudulent transactions.

Automated Recurring Billing

Automated Recurring Billing (ARB) is a convenient and easy-to-use tool for submitting and managing recurring, or subscription-based, transactions. Whether your business is subscription-based or has repeat customers, easy recurring billing tools improve billing efficiency and security and eliminate the hassle of manually re-entering billing or payment details for every transaction.

Secure Customer Information Management

In addition to providing a great checkout experience for your customers by enabling a frictionless checkout, a payment gateway may enable you to create and store customer payment and address data for subsequent use.

A payment gateway that includes a Customer Information Manager (CIM) enables you to tokenize and store your customers’ sensitive payment information on the payment gateway’s secure servers, simplifying your PCI DSS compliance as well as the payments process for returning customers and recurring transactions.

Customers can save billing, payment and shipping information for future orders. Profiles can include multiple payment methods and shipping locations for added ease of use. And you can manage customer profiles and issue transactions manually from within the merchant Interface or integrate with your website or app using the Application Programming Interface (API).

By Analyzing your stored customers’ profiles you are better able to to match their preferences in the future.

You can analyze payment data in order to gain insight into inefficiencies in your payment processing flow, as well as to gain an improved understanding of customer behavior on your website. This data can indicate checkout deterrents, which can be used to cater to customer preferences in the future.

Recognizing return customers provides a seamless and effortless checkout experience for returning customers. When a return customer reaches the checkout and requests to pay, tokenization technology uses the token associated with the customer to recall the stored payment data from the payment gateways’s secure servers. This minimizes your risk and effort in securing the payment and ensures the functionality of the checkout without taking your customers out of their comfort zones – or your brand experience.

Simple Checkout

Simple Checkout enables you to create “Buy Now” and “Donate” buttons for your website simply by copying/pasting simple code. Simple Checkout is a great solution for donation sites and merchants that typically sell one item per order.

Easy to use and well documented Application Programming Interface (API)

An important feature of a payment gateway is an API that is complete and scalable, which enables you to accept any type of payments, from website to app and integrate your eCommerce website with the payment gateway’s API. Your customers stay on your website and you have complete control over every aspect of the payment process.

Conclusion

Improvements to the checkout process provide unparalleled opportunities for driving eCommerce website conversions.

By choosing the right payment gateway and using the included payment processing features effectively, your eCommerce website can get amazing results, in terms of increased conversions, happy customers, and reduced shopping cart abandonment.

Contact us for a free evaluation of your eCommerce payment gateway and help using the advanced payment processing features effectively.